Setting the Stage: Time to Deep-Six the Death Tax

Setting the Stage: Time to Deep-Six the Death Tax

By: Patrick Hedger - Policy Director, American Encore

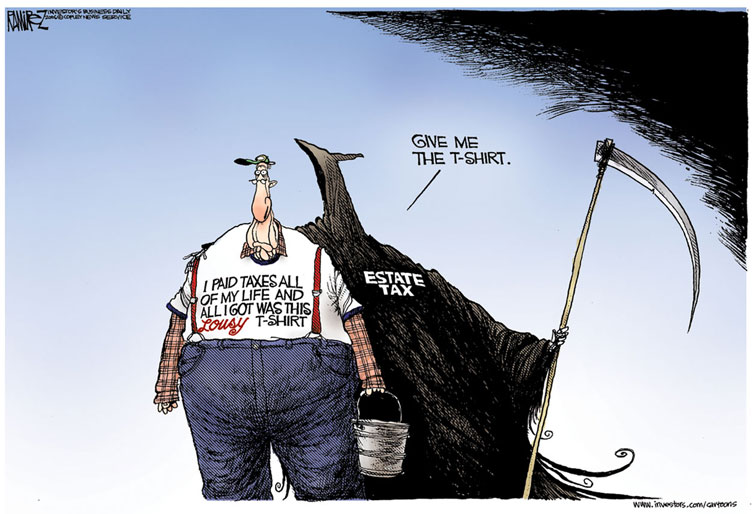

Most of us are familiar with some variation of the phrase, “There are only two certainties in life: death and taxes.” (Some have comically pointed out that such a grouping is an insult to death.) However most Americans are probably not aware that a combination of the two exists. The Estate Tax, also known as the death tax as I will refer to it, is literally a tax owed to the government on your estate or net assets when you die. To be clearer, the death tax is a percentage of the value of everything you own, tangible and intangible, above a certain threshold that you owe when you die. And when I say everything, I mean everything; per the IRS itself, “It consists of an accounting of everything you own or have certain interests in at the date of death.”

Right off the bat, it’s hard not to get a sense that there is something deeply flawed with such a policy, even if it’s just on moral grounds alone. By its very nature there are a few fairly reprehensible givens with such a policy. First off, where every other tax we have on the books is prompted by a gain, such as new income or a new purchase, the death tax is the only one triggered by not only a loss, but by tragedy itself. And obviously, because the person who the death tax is being levied on is… well… dead, it falls on their survivors to orchestrate all of the necessary procedures for compliance with the tax.

Whether it comes by natural causes, sickness, an accident, or something unspeakably worse, the death of a loved one is something that brings about unimaginable pain and stress. Putting aside all other differences, I think everyone can agree that the last thing anyone needs following the loss of a loved one is endless meetings with lawyers, accountants, and IRS agents to figure out how large of check needs to be cut to Uncle Sam.

These are the obvious problems with the death tax and they probably account for why polls routinely show that the overwhelming majority of Americans, when informed and asked about the death tax, favor eliminating it. Yet the death tax still exists and continues to create unnecessary anxiety for those with elderly or ill loved ones that own businesses or have cherished investments. What’s worse is that for how morally backward the policy is, it doesn’t make even a shred of economic sense.

The cold-hearted proponents of the death tax want you to believe that it is only a tax on the richest among us whose families can no doubt afford to pay it. And, after all, who needs all that money when they’re dead right? It is true that only those with more than $5.34 million in assets are subject to the tax this year and even then the tax only applies as a percent of every dollar assessed above that threshold, not below.

The problem is that the death tax isn’t just a tax on pools of money, gold, and jewels sitting in some bank vault somewhere. Lose the Scrooge McDuck imagery right now. As stated before, the death tax is determined a percentage of all assets and investments. This includes, homes, cars, stocks, land, cattle, etc. More to my point, this also includes businesses. The tax is no haircut either. The 2014 rate is 40 percent, but it has been as high as 70 percent as recently as the 1980s. That 40 percent, by the way, can also be on top of double-digit state-level death taxes on the books in 19 states and the District of Columbia.

What the death tax sets up is a perilous situation for small, family-owned businesses. If a family member owns the entirety of or a major share in a privately-held business, their death forces the surviving members or inheritors to come up with the cash equivalent of 40 percent of the deceased’s stake in the company. Let that really sink in for a moment and think about everything involved with owning and operating a business. It doesn’t take too long to realize that the term “death” tax holds a duel meaning. This policy kills businesses.

Consider any privately owned business. Think about the basic needs to keep virtually any kind of brick-and-mortar business operating: land, structures, electrical and plumbing fixtures, vehicles, machinery and equipment, computers, office supplies, raw materials, parts, tools, merchandise, and finished products. It’s not difficult to imagine that for a business the size of no more than a few dozen employees that these assets alone could push the value of the business close to if not beyond the $5.34 million required to trigger the death tax. And all of that is before you consider the business’s various savings and spending accounts and investments. There is not a single business owner in the country able to cut a check for 40 percent of their company’s net worth today and keep their doors open tomorrow.

The death tax forces small businesses that experience an ownership death to immediately begin liquidating assets and, as any business owner will tell you, their most easily dispatched cost is labor. So first go the jobs created by the company. Next goes the company itself, as it is forced to sell the very things it requires to do business in order to make enough cash available to comply with the tax. As devastating as this is for the business and its employees, it is also a drag on the entire economy. Unemployment rises, fewer investments and capital purchases are made, and prices rise across the market as competing firms adapt to reduced competition. In addition, we are all deprived of the choice to purchase whatever good or service that company offered.

If this seems like a far-fetched scenario, I assure you it’s not. A recent story from just outside Seattle, Washington resembles the exact scenario I just posited and reminds us that the impact of the death tax is very real on survivors. Per the Seattle Times:

“The story of the McBride family, recounted by Seattle Times reporter Erin Heffernan, shows us what we lose as a result of the estate tax — in this case, the last working farm in a fast-growing suburb. Twelve acres of open space farmed by a single family since 1883 will soon become a subdivision. The family had to sell, explained Jim McBride. ‘There wasn’t any other thing for us to do. All my parents’ wealth was in that land, and we couldn’t afford to pay the taxes that come with inheriting it at the current property value.’

The McBride case ought to show us conventional thinking is wrong — the death tax really isn’t a whack on the wealthy.”

It certainly is not. In addition, as recently as 2001, the death tax threshold was a mere $675,000 taxed at a 55 percent rate. This would impact countless more families and businesses that would by no objective measure be considered “rich”. It would be foolish to think the tax couldn’t reach that level again.

The only way to be sure that death tax won’t continue to destroy more and more family businesses and the decades of hard work that they are worth is for Congress to permanently repeal it. Luckily, such a plan is already on the table… and a lot of members of Congress are supporting it.

Last summer, Representative Kevin Brady, (R-TX) introduced H.R. 2429, which would permanently repeal the death tax. The bill enjoys enormous and bi-partisan support in the House. It has 221 cosponsors, already a majority of the 435-member body, including a handful of Democrats. When Congress returns from recess in September, this bill should immediately come to a vote, as it is a guaranteed pass to repeal a policy the American people overwhelmingly resent.

Of course there are those that do defend the institution of the death tax, however arguments in favor of the policy don’t really hold a candle to the fact that the tax vaporizes small, family-owned businesses.

Eliminating the death tax would reduce incoming revenue to the Treasury in the short-term. However, on the scale of government receipts and outlays, scrapping the death tax would have a microscopic impact. This year, combined estate and gift taxes, according to the Office of Management and Budget, will bring in an estimated $15.746 billion. It’s hard to say how much exactly of this total comes from the death tax and what constitutes gift taxes, but we can make an educated guess based on the 2010-2011 numbers. In 2010, the death tax was temporarily suspended in its entirety. The following year, 2011, the government collected a combined $7.4 billion from estate and gift taxes, down from $18.885 billion in 2010 and below the $18.912 billion collected in 2013. Therefore it seems fair to estimate an average value of estate tax revenues at about $10-11 billion.

This year, the federal government will collect just above $3 trillion in taxes. That puts the death tax somewhere around .3 percent of total federal revenue (Not three percent—point three percent). As concerned as we all should be about the state of federal finances, the deficit, and our growing national debt, clinging to spare-change revenue from a tax that eats away at the foundation of our market economy isn’t the answer. Besides, according to the intergovernmental watchdog Government Accountability Office, eliminating redundant federal programs could save taxpayers at least $45 billion a year, over four times the amount raised by the death tax.

But just as the arguments against the death tax are not exclusively economic, neither are the ones in favor of it. Some believe the death tax is a necessary tool for societal engineering. They see the death tax as a way of curbing two perceived problems: lazy rich kids and powerful families.

Supporters of the death tax see it as a way of forcing the children of our nation’s wealthiest citizens to go out and become successful contributors to society instead of lazy bums living off the trust fund. These kids need to know what a hard day’s work entails after all, right? Well, there’s a big problem with that line of thinking. First off, this entire idea is a distant cousin of economic technophobia. Economic technophobia or, as famed economist Henry Hazlitt referred to it in his classic book Economics in One Lesson, “the Curse of Machinery”, is the belief by some that machines and technological innovations cause economic harm by reducing the amount of work that needs to be done to accomplish certian tasks. Despite the thorough debunking of this myth by Hazlitt in his book, which was published in 1946, policy makers today still subscribe to this kind of nonsensical thinking about economic progress. President Obama himself made this statement in 2011:

"There are some structural issues with our economy where a lot of businesses have learned to become much more efficient with a lot fewer workers," he said. "You see it when you go to a bank and you use an ATM, you don't go to a bank teller, or you go to the airport and you're using a kiosk instead of checking in at the gate."

If this was really the case, that technology is the reason for long-term unemployment and economic hardship, then why stop at the ATM? Forget reinventing the wheel let’s destroy it! Someone tell Zeus to unchain Prometheus, we’re giving fire back to the gods (click here for context). The point is that human civilization has not become more advanced by keeping everyone as busy as possible. Instead, we see progress when technology and innovation liberate our productive efforts and leave us free to pursue new challenges. Does wealth not do the same?

This brings me to the close of this digression and back to the rather ridiculous idea that the death tax stops lazy trust-funders from dragging on the economy. Families that have built up great wealth leave their descendants in a better position to pursue ventures for reasons that are not entirely economic. Children and grandchildren of the rich and famous quite often go on to become great assets to society through work that they engage in for their own personal enrichment or through charitable purposes. There are countless examples of this, from the Rockefellers, the Fords, the Pritzkers, and the Waltons, to the Kennedys, the Bushs, and now even the Clintons. In this light, the argument for the death tax, which would thus essentially set those with the time, resources, and inclination to make society better back to square one, seems entirely backwards.

The other moral argument for the death tax stems from a feeling some readers may have felt from reading that last passage – a fear of some families and their companies becoming too powerful. This is a legitimate concern, but the death tax is far from an effective remedy. In fact, it actually eliminates the most effective way of combating such a problem: competition. Small businesses with new ideas, products, and services are the most effective check against large corporations and powerful families. Small, family-owned companies are the cradles of business ideas that keep powerful conglomerates on their toes or put them out of business. Yet the death tax looms large over these privately-held small enterprises, threatening to destroy them before they can even reach the next generation. Meanwhile, powerful companies and families are able to hire the best and brightest attorneys and accountants and purchase favor in Washington to avoid feeling the brunt of the death tax. Again, the Clintons provide us a wonderful example. Therefore, in this regard, the death tax is completely adversative to our values.

All things considered, the death tax amounts to unnecessary pain on those already suffering from the loss of a loved one without any realistic benefit to society as a whole. In fact our broader society suffers because of the death tax's continued existence. The tax acts like an herbacide, killing the business roots from which our entire economy grows and leaving it top heavy. The result is fewer jobs, fewer investments, fewer customers for manufactuirng equipement and other products needed to do business, and less of the healthy competition that our supposedly "free" market economy needs. And all of that comes after considering how moraly reprehensible it is to impose a 40 percent (or more) tax on someone's life's work and family simply because they died.

To set the stage for the next great American century we need to get our economic and moral house in order and we can start by killing the death tax.