E-Testimony Against the EPA's War on Power Part 2

E-Testimony Against the EPA's War on Power Part 2

Part 2: Energy Security

By: Patrick Hedger, Policy Director-American Encore

This past week the Environmental Protection Agency (EPA) held a series of hearings across the country in regards to the agency’s recently proposed regulation targeting national carbon emissions. However, reports have surfaced that many prominent voices in opposition to the proposed standards were unable to secure speaking slots at what were supposed to be public hearings. Whether or not this is simply an administrative error or another deliberate attempt by the Obama administration to choke dissenters with red tape, the case against the EPA’s proposed rule must be made and heard by the American people.

Background: The EPA’s proposed regulation, called the Clean Power Plan (CPP), is a set of percentage targets by which carbon emissions from power plants must be reduced that are assigned to each state. The combined national carbon emission reduction target under the CPP is 30 percent by 2030 based on the 2005 baseline of carbon emissions. Under this rule, states must develop and submit to the EPA plans to achieve the goal assigned to them by EPA bureaucrats in Washington. Failure to submit an adequate plan by a state would result in the EPA crafting a plan of its own design for the given state.

Overview: The CPP, as proposed, raises a number of serious concerns divided into two distinct categories. The first of these, naturally, is the slate of the potential economic impacts resulting from implementation of the proposed standards. Studies suggest that the CPP could severely damage the nation’s fragile economic recovery and undermine the reliability of the nation’s power supply all while failing to have any sort of significant impact on global carbon emissions. The other major category of concern is more philosophical. The mere proposition of the CPP by EPA raises alarming questions regarding the separation of powers under the Constitution and the understanding of the role of government that exists within the ranks of Washington’s increasingly powerful bureaucracies. This three-part series will begin by looking at the economic outcomes of the CPP. Part two will look at the potential for CPP complaince outcomes to damage energy security. Part three will then show how the plan is all cost with no benefit as it will fail to make any sort of significant impact on global carbon emissions. Finally, part four will look at the CPP from a purely philosophical standpoint and explain why it signals a breach of the Obama administration's constitutionally delegated role in governing.

Part 2 - Energy Security: Artificially expensive energy prices pose obvious risks to the overall economy. In sum, families and businesses find themselves paying more for energy services while receiving no additional tangible benefit. They are using the same number of lights, electronics, and machines at the same rate yet it is now more expensive to do so. All that this does is incentivize families to consume less and businesses to produce less as previously available resources are diverted away from consumption, investment, and hiring towards simply keeping the lights on and doors open. Advocates of environmental regulation constantly speak of efficiency, but such a scenario is model of economic inefficiency. Yet as problematic as the rising cost of keeping the lights on may be for the economy, what is potentially more troublesome is the risk of the lights not coming on at all!

While families may struggle to cope with more expensive power bills, businesses can increase their prices to mitigate some of the direct impact and disperse the cost to their customers, to an extent at least. However, it is much more difficult to socialize the cost of a complete inability to do business as a result of nothing happening when a switch is flipped. The ability to do business at all is certainly a more basic consideration than the cost, meaning that unreliable energy is far more likely to discourage companies from opening and expanding than anything else.

In Part 1 of this series, it was explained how the EPA’s Clean Power Plan (CPP) will exacerbate current economic stagnation and potentially reverse growth as utility companies pass on the enormous cost of compliance to consumers through higher electricity bills. This section will explore the risk of the CPP creating a worse situation by facilitating electricity shortages.

The CPP itself is built on four strategy “building blocks” identified by the EPA. Each block is a way to accomplish a portion of the required reductions in aggregate carbon emissions. One these building blocks calls for a mass-transition towards “low-emitting” power sources. It’s no secret that here the EPA is referring to a nationwide transition away from baseload coal-fired electric power plants towards those fueled by natural gas. Some experts estimate this could mean that natural gas demand in the electric utility sector could grow by 50 percent or more under the CPP.

The reasoning behind this is that natural gas is abundant and burns cleaner, in most terms including carbon release, than coal. Yet coal is more abundant and has historically been less expensive and therefore slightly more economical for electricity production than natural gas. Coal can also be transported more easily via existing infrastructure, on trucks or by train, versus natural gas, which generally requires extensive pipelines to be built for large-scale transportation. For these reasons coal has a natural edge in a free market. Thus the EPA’s goal with the CPP is to put its finger on the scale in favor of natural gas. The EPA seems to view replacing coal capacity with natural gas as an inconsequential switch from one cheap resource to one slightly less cheap resource. Of course, as is the case with most government edicts, the reality is far more complicated.

Apart from the obvious differences in physical characteristics and those associated with price and abundance, there is a key difference between coal and natural gas that makes the CPP indeed exceedingly consequential for Americans. That difference is best summarized by the following question: When was the last time you used coal at your home or business?

The point is that demand is already high for available natural gas supply in the residential, commercial, and industrial sectors. Therefore, artificially inflating demand for natural gas in the electric utility sector across the country naturally presents a major problem; a problem that we are already seeing play out in a region of the country that has pre-empted EPA action in switching away from coal in favor of natural gas.

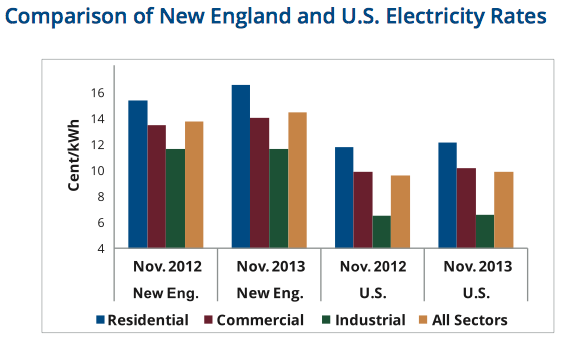

A recent report issued by the Institute for Energy Research (IER) looked at the precarious situation unfolding in New England in regards to the region’s electricity supply. What the report found is that not only do New Englanders pay well above the nationwide average for electricity, but current policies have the region in a position to begin experiencing rolling brownouts and blackouts as soon as next winter.

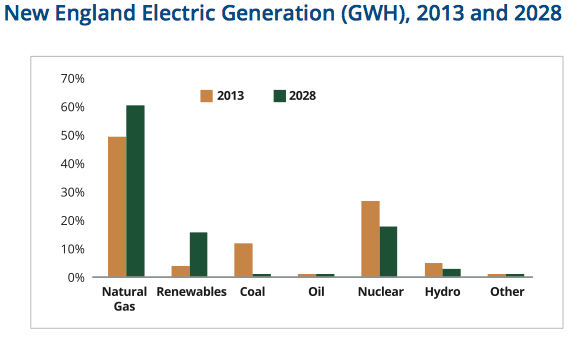

According to the report, in 2013 roughly half of New England’s electricity generation came from natural gas. The rest came from a mixed bag of coal, oil, nuclear, hydroelectric, and various renewable energy facilities.

In addition, the share of electricity generated and consumed in New England from natural gas is projected to only rise in the years to come at the expense of mostly all of the latter resources. The report goes on to highlight the concerns raised and warnings issued by multiple independent experts and regulatory agencies at the regional and national level about this current and increasing reliance on natural gas-fired electricity. The general concern is that due to structural issues within the natural gas market, seasonal spikes in demand for natural gas in residential, commercial, and industrial sectors of the market could lead to supply shortages in the utility sector. The problem here is obvious: if power plants don’t have a reliable supply of fuel, consumers will not have a reliable supply of power.

The problem stems from the fact that natural gas is considered a “just-in-time” resource. What this means is that it is rarely stored and is instead used as soon as it is delivered, unlike oil and coal, of which power companies can order and store reserves. Natural gas is sold from the major supply pipelines into regions in two forms: firm and interruptible supply. Think of these as guaranteed and surplus supply, respectively. Natural gas utilities, the companies that supply gas to the residential, commercial, and industrial sectors, set up firm supply contracts with the regional pipelines which give them a guaranteed supply on a daily basis. Firm gas capacity is more expensive, however those companies that opt for it draw on the gas supply at generally a low, consistent, and predictable rate. The pipeline companies prioritize these customers. The electricity market, however, doesn’t lend to the establishment of guaranteed supply contracts. Therefore market forces direct electric utilities to opt for interruptible or surplus gas service. Interruptible gas supply is provided from what the firm customers do not use and is therefore more inexpensive. However, when demand from firm customers increases, as it does in the winter when people are using more gas to heat their homes and businesses, less surplus gas is available for power plants to draw on. The result is that power plants are unable to generate electricity. Natural gas suppliers are unable to increase supply to meet these needs because of limitations on what the regional pipelines can handle and without additional firm contracts, which are uneconomical for the electric power companies, gas suppliers will not build new pipeline infrastructure, and in fact cannot due to Federal Energy Regulatory Commission rules. (Read more on this issue here)

While this may sound like a theoretical problem, it is on the cusp of becoming a very real issue in New England. Per the IER report:

“At one point in January 2014, 75 percent of all gas-fueled power plants [in New England] were shut down and about 40 percent of electricity was being provided by coal and oil.”

The report goes on to highlight that this stopgap electric supply from coal and oil came from facilities scheduled to be taken out of service and replaced with more natural gas! The result is that high natural gas demand in the coming winters could leave New Englanders unable to use three-quarters or more of the plants that generate a growing majority of their electricity without flexible backup. Of concern for the rest of the nation is that New England’s energy portfolio for electricity generation arguably mirrors what the EPA envisions for the rest of the country under the CPP.

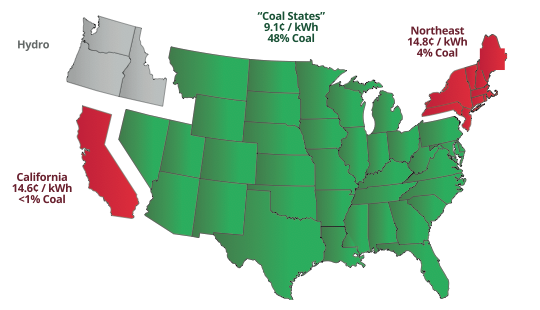

The strength of an energy market is measured in terms of affordability and reliability. Thus far we can conclude that the EPA’s plan to regulate carbon emissions jeopardizes the American electricity market in terms of both tenets. As Part 1 warned, the CPP stands poised to impose hundreds of billions of dollars in compliance costs on electric utilities, who will then surely pass them on to American families and businesses via rate hikes. We’ve already seen this play out on a smaller scale, where the transition away from coal-fired power has residents of the Northeast paying over 62 percent more per unit of electricity than residents of most other states.

Yet what the Northeast and New England in particular are set to demonstrate for the rest of the nation is that increasing dependence on natural gas in lieu of coal doesn’t just come at enormous financial expense. In addition, it may also require sacrificing the assurance that when you flip a switch the lights will come on. It’s hard to imagine a greater disincentive for businesses to invest somewhere than the absence of such an assurance, yet that is exactly what the CPP would impose on the entire United States.

As we’ve seen, the cost and sacrifice of implementing the CPP is undeniably enormous. Billions of dollars, millions of jobs, and a priceless piece of mind. Yet for all of this cost, is there a benefit? Is the EPA’s plan to reduce carbon emissions worth the risk? In a word: no. As the next part of this series will demonstrate, the Clean Power Plan is all cost to the American people with virtually zero domestic or even global benefit.